Reliance Industries Limited (RIL), India’s largest conglomerate, remains a dominant player in the stock market with interests spanning energy, petrochemicals, telecom, retail, and green energy. As of July 21, 2025, the Reliance share price stands at ₹1,447.20 on the NSE, sparking keen investor interest in light of its historical strength and diverse portfolio.

Let’s dive into an in-depth analysis of Reliance Share Price 2025, recent trends, technical outlook, and whether it’s a smart buy now.

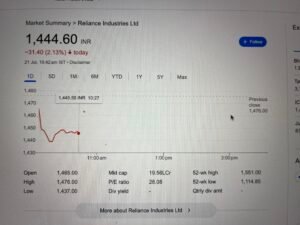

Latest Reliance Share Price Snapshot (as of July 21, 2025)

| Parameter | Value |

|---|---|

| Opening Price | ₹1,465.00 |

| Day’s High/Low | ₹1,476.00 / ₹1,440.60 |

| Current Price | ₹1,447.20 |

| Previous Close | ₹1,476.00 |

| Market Cap | ₹19,97,393 Cr |

| 52-Week High/Low | ₹1,593.90 / ₹1,114.85 |

| P/E Ratio (TTM) | 28.68 |

| Dividend Yield | 0.37% |

| Volume (Today) | 12,57,015 |

Performance & Financial Health of Reliance

Reliance’s diversified revenue base gives it a unique edge in navigating market cycles. Here’s how the stock has performed recently:

Past Returns:

-

1 Month: +3.19%

-

3 Months: +15.81%

-

6 Months: +13.06%

-

1 Year: -2.98%

-

3 Years: +34.24%

-

5 Years: +69.36%

Despite a dip over the past year, Reliance remains a long-term outperformer, supported by solid fundamentals.

Reliance Share Price 2025

Key Financials:

-

Net Profit (YoY): ₹30,681 Cr (+75.84%)

-

Quarterly Sales: ₹2,43,632 Cr

-

ROE: 9.87%

-

ROCE: 11.29%

-

Debt-to-Equity: 0.41

-

EBITDA Margin: 19.07%

-

EPS (TTM): ₹51.47

These numbers highlight Reliance’s strong profitability, prudent debt levels, and operational efficiency.

What’s Driving Reliance Share Price in 2025?

Several key factors support investor interest in Reliance:

1. Diversified Revenue Streams

From oil & gas to telecom and retail, Reliance’s wide portfolio provides revenue stability and shields it from sector-specific downturns.

2. Expansion into Growth Sectors

Investments in green energy, digital services, and e-commerce continue to fuel future earnings potential.

3. Consistent Profit Growth

Quarter-on-quarter profit growth, especially from Jio Platforms and Reliance Retail, supports valuation premiums.

4. Market Influence

As a heavyweight in Sensex and Nifty 50, Reliance mirrors broader market sentiments and often leads benchmark index movements.

Risks & Volatility to Consider

While fundamentally strong, Reliance is not immune to short-term risks:

-

Volatility: Intraday range of ₹1,440.60 – ₹1,476.00 shows active trading and potential price swings.

-

Oil Price Dependence: As a major energy player, Reliance is sensitive to global crude price changes.

-

Regulatory Shifts: Government policies in telecom and retail sectors can affect earnings outlook.

-

Market Sentiment: Broader macroeconomic conditions and foreign institutional activity heavily impact share movements.

Dividend Policy & Shareholder Value

Reliance maintains a modest but steady dividend payout with a yield of 0.37%, indicating a preference for growth investments. Investors benefit not just from dividends, but also from long-term capital appreciation.

Technical Indicators (As of July 21, 2025)

| Indicator | Value |

|---|---|

| 50-Day Moving Average | ₹1,459.57 |

| 200-Day Moving Average | ₹1,323.37 |

| RSI (14-day) | 47.79 (Neutral Zone) |

The short-term trend appears slightly bearish, with the current price below the 50-DMA. However, the long-term moving averages suggest a bullish trend, offering a potential entry point for long-term investors.

Analyst Outlook for Reliance

Most brokerage firms and market analysts maintain a “Buy” or “Accumulate” rating, citing:

-

Market leadership in energy and telecom

-

Ongoing investments in AI, 5G, and green hydrogen

-

Strong balance sheet and cash flow generation

Future projections suggest that a rebound could be on the horizon, especially if favorable macroeconomic triggers or new revenue streams are realized.

Should You Invest in Reliance in 2025?

Best For:

-

Long-Term Investors: Ideal for those aiming to build wealth steadily over 3–5+ years.

-

Growth-Oriented Investors: New ventures and innovations continue to offer upside.

-

Low-Risk Seekers: Its blue-chip status and financial strength offer downside protection.

Watch Out For:

-

Q1 and Q2 FY26 earnings

-

Global oil price movements

-

Jio and retail business updates

-

Government regulations in telecom, energy, and retail

FAQs on Reliance Share Price 2025

Q. Is Reliance a volatile stock?

Moderately. It reacts to both domestic and global factors.

Q. What’s the dividend yield?

0.37% — Reliance balances payouts with reinvestments.

Q. What is its P/E ratio in 2025?

28.68 — indicating positive investor sentiment toward future growth.

Conclusion: Should You Buy Reliance Shares Now?

With a price around ₹1,447, Reliance offers an attractive opportunity for investors seeking long-term gains backed by India’s growth story. While short-term volatility exists, the fundamentals, diversified earnings, and strategic investments make it a reliable bet for portfolios in 2025.

Before investing, always consult a financial advisor and align your decisions with your personal investment goals and risk appetite.

Disclaimer:

The information provided in this article is for educational and informational purposes only and should not be considered as financial or investment advice. Please consult a qualified financial advisor before making any investment decisions.

Leave a Reply